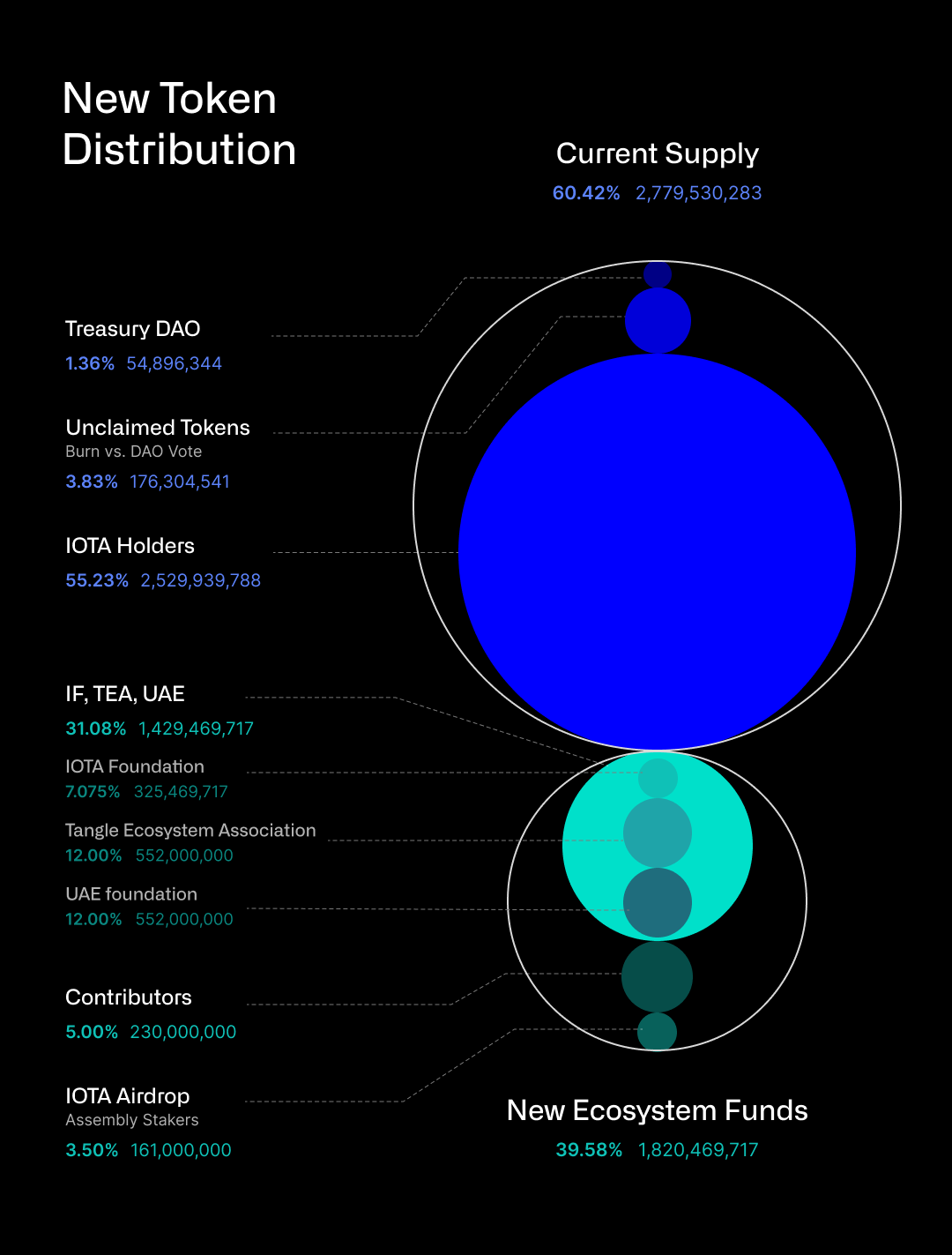

- Since IOTA increased the token supply last year to 4.6 billion—up from an initial 2.79 billion—there have been concerns that this has suppressed its price.

- However, one ecosystem member says the increase was in line with the broader inflation, other major tokens experienced similar figures, and it’s the ecosystem growth that ultimately matters.

In September last year, IOTA made a massive announcement, revealing that it would increase the supply of IOTA tokens from 2.79 billion to 4.6 billion. Since then, some analysts have claimed that the new tokens have been the key factor suppressing the price of the token. However, one community member argues that what the ecosystem builds on the network is more important than the token inflation.

In its September 2023 announcement, IOTA revealed that it would release new tokens every two weeks for the next four years, presumably up to the end of 2027. Of the new 1.82 billion tokens, the ecosystem fund, which includes the IOTA Foundation and the Tangle Ecosystem Association, would receive 31%, the highest share. The funds would go towards supporting developers to build on IOTA. Contributors received 5%, while Assembly stakers got 3.5%.

Did IOTA’s Supply Increase Suppress the Price?

Since the announcement, debate has been heated over the effect it has had on the price. IOTA’s price has dipped 22% since September last year. However, in that time, it has surged to a yearly high of $0.4146 in March this year, which sent its market cap to $1.32 billion.

He states that today, the token supply has only increased by 24.5% (currently stands at 3.48 billion).

This may seem like a lot, but when we consider USD inflation (which has grown by 29% over the same period), things start to look very different…The takeaway? The supply increase has not hurt IOTA’s value as much as you might think.

Thread: Why IOTA’s Supply Increase Isn’t a Problem 🧵

1/ 🌐 Since IOTA reached its All-Time High (ATH) of $5.69 in December 2017, much has changed in the crypto landscape—both in terms of token supply and the value of fiat currencies like the USD.

2/ 📈 IOTA’s supply has… pic.twitter.com/FttRRsj8Nn

— B effect.iota 🦋🐝 (@karlaxelm) October 22, 2024

The member further notes that IOTA has been getting a bad rep like it was the only token whose supply had increased since it hit its all-time high back in 2017. In that time, BTC supply has grown 18%, while Ethereum’s is up 25%. Cardano has increased by a much bigger rate than IOTA at 35%. However, all these projects haven’t been attacked and accused of suppressing the price.

He adds:

The increase in supply is common for most crypto projects, and it’s a natural part of blockchain ecosystems, especially those with staking rewards or inflationary mechanisms.

Token inflation isn’t the most important factor for a crypto project, the member added. Rather, it’s more about “expanding the ecosystem (IOTA 2.0, SCL1, Shimmer), which brings value far beyond supply metrics.”

Remember: Market dynamics, adoption, and technological advancements will ultimately drive long-term value. The supply increase is a part of this evolution, not a hindrance.

IOTA trades at $0.1169, dipping 1.7% in the past day to bring its weekly losses to 5.3%.