- Solana (SOL) shows a bullish outlook as Daily Active Addresses reach a record high while daily transactions outshine those of Ethereum, Cardano, and Binance.

- A Solana whale makes 34,807 SOL ($4.52 million) purchase, bringing the total assets withdrawn into his self-custody wallets to 207,000 SOL (over $29 million).

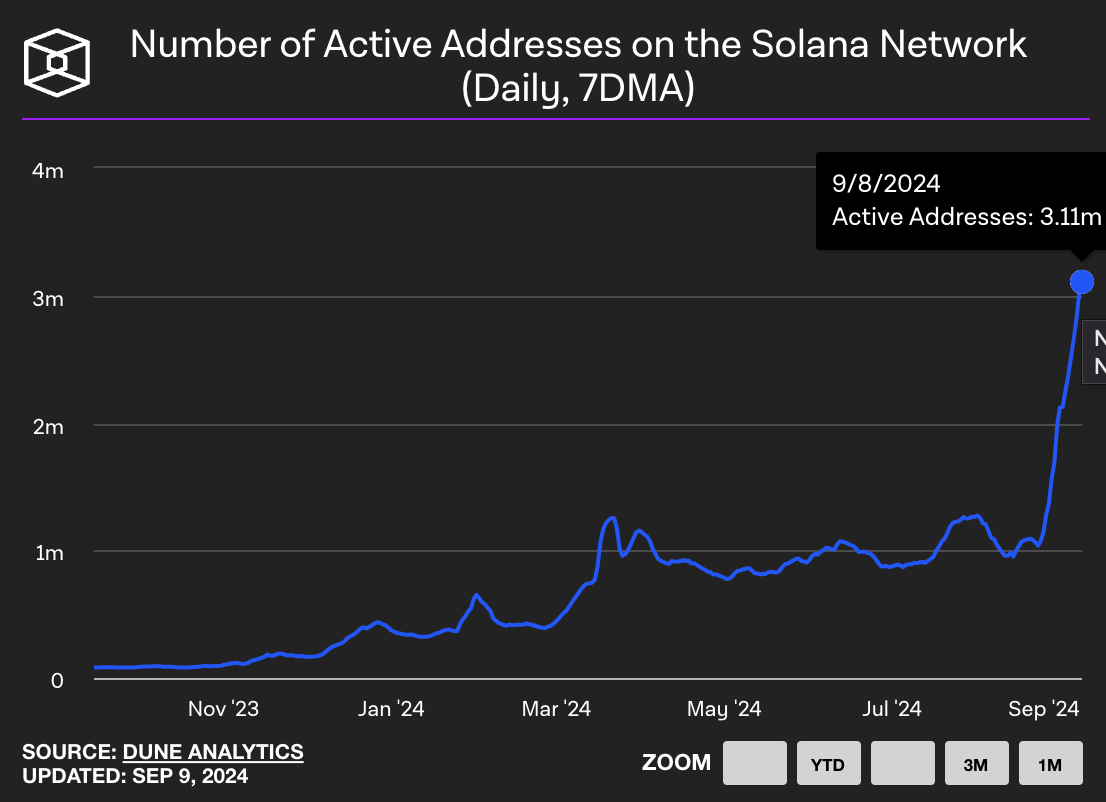

Solana’s (SOL) on-chain activities, precisely the Daily Active Address (DAA), have reached a record high in almost a year, setting the grounds for a potential significant upsurge.

According to Dune Analytics data, the figure has risen threefold to hit 3.11 million in the last 30 days. This incredible surge is reportedly fueled by the creation of new tokens, particularly, meme coins.

In calculating the daily active addresses, analysts consider the number of transactions occurring on the network daily. They mostly use buy, sell, or swap. The rise in this metric indicates an increase in demand for the underlying asset or higher utility among traders.

Subjecting data from Artemis Terminal to further analysis, we observed that Solana’s DAA reached a high of 5.4 million on September 9. According to historical data, this is the highest ever recorded. Prior to this height, the DAA initially reached 4.6 million on September 6 and fell to 4 million and 2.8 million on September 7 and September 8, respectively.

Within the period under review, Solana’s total daily transactions reached 40.3 million, exceeding the likes of Ethereum, Cardano, and Binance Smart Chain.

New Addresses Hits New Heights as Solana Whale Activities Increase

Another look at Hellomoon data discloses that the number of new addresses created was around 22.88 million as of September 10. Surprisingly, this represents 57% of the total new addresses created in August. Amidst these incredible numbers, Solana’s network fees dropped to its six-month low, with 3,800 SOL in fees generated as of August 31. On September 6, the figure saw a slight recovery to 4,000 SOL. This represents a considerable fall from the average daily fees of 10,000 SOL recorded in the year’s second quarter.

In investigating these unexpected numbers, we observed that the decline in fees could be partly attributed to the significant decline in the Pump.fun’s popularity. According to reports, fees of Solana’s coin creation platform witnessed a whopping drop of 82% from the $2.31 million recorded. As of early last week, the fees had fallen to $409,000.

Despite these bullish readings, the price of SOL has remained 2% down in the last 24 hours and 9% down in the last 30 days, trading at $131.

Days ago, SOL staged a mini rally to surge from $123 to $137; however, bears strongly resisted this bullish attempt to drag the price down the price curve.

Conversely to the current price action, whale activities have picked up as a user purchases 34,807 SOL ($4.52 million) at $134. According to reports, this whale has withdrawn about 207,000 SOL (over $29 million) into self-custody wallets since February 2024. On the same day of the recent purchase, another whale who owns 1.84 million SOL ($246 million) sold 20,000 SOL tokens ($2.66 million). This brings his total sales to 715,000 SOL ($102 million) since the beginning of the year.