- Shiba Inu (SHIB) is showing signs of a potential bullish breakout due to increased network activity.

- On-chain metrics such as price-DAA divergence, funding rates, and transaction volume support the positive outlook for SHIB’s price rise.

Shiba Inu (SHIB) may be gearing up for a bullish breakout following a prolonged period of consolidation, with several key indicators pointing towards upward momentum. The current interest rate cut by the Federal Reserve has revived the cryptocurrency market, and subsequently, SHIB’s price has seen an uptick in trader confidence and a high possibility of a huge price surge.

The Federal Open Market Committee (FOMC) recently announced an interest rate cut of 50 basis points, which has led to beneficial changes in the cryptocurrency market as a whole, including the price of Shiba Shiba Inu was trading at $0.000012 two weeks ago and investors were apprehensive of a bearish performance. However, after the rate cut, the price is trading at $0.000014, which shows that traders are now hopeful again.

The interest rate cut has eased market liquidity, in the market, this means that investors are willing to take more risks which has directly influenced the price of SHIB. Retail and institutional traders have returned to the market as they expect further increases in prices due to better liquidity and increased network activity.

On-Chain Metrics Support Bullish Outlook

One of the key indicators of Shiba Inu’s current trajectory is the price-Daily Active Addresses (DAA) divergence. As the price rose to $0.000012, the price-DAA relationship was negative, implying that the price rise was not backed by adequate blockchain action. This meant that price action was probably not sustainable at that time, at least to that extent.

However, the situation has changed. The price-DAA divergence is now positive at 15.90%, which means that the recent price rally in SHIB is supported by an increasing number of users on the Shiba Inu network. Rising network activity is crucial for maintaining upward momentum, and this shift signals that SHIB could be positioned for further gains.

This optimistic view is backed by the increase in SHIB derivatives volume from Coinglass data. Spot and derivatives markets have been relatively dormant up until now, but the increase in trading volumes indicates a rising interest in the token. This has occurred alongside a change in the funding rate, which has become positive, meaning that traders are currently more likely to hold long positions with the expectation that prices will continue to rise.

Key Support Levels Strengthen SHIB’s Position

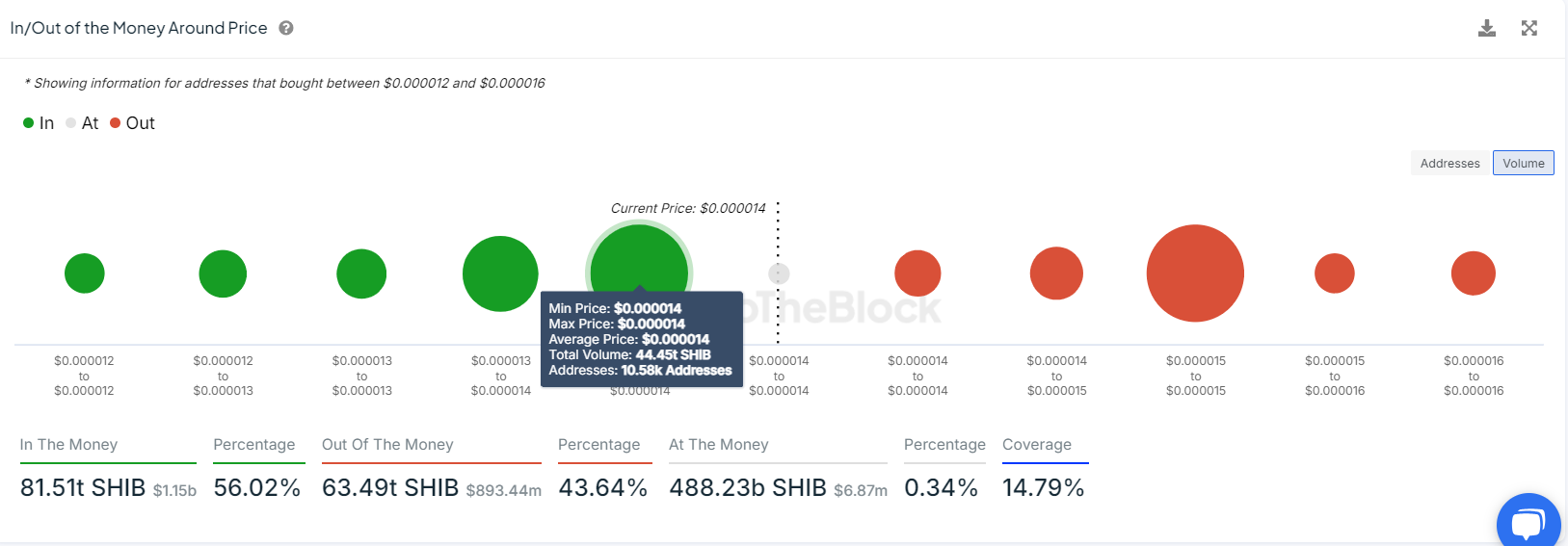

Shiba Inu’s technical indicators also show signs of strength. According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) data, around 10,580 addresses held 44.45 trillion SHIB tokens at an average price of $0.000014. This level is now considered a major buy zone, given that many tokens were purchased at this price level.

The $0.000014 level is not only crucial from a market structure perspective but also aligns with other technical analysis findings, reinforcing its importance as a reversal point. Should the price hold at this level, it could provide a solid foundation for further upward movement.